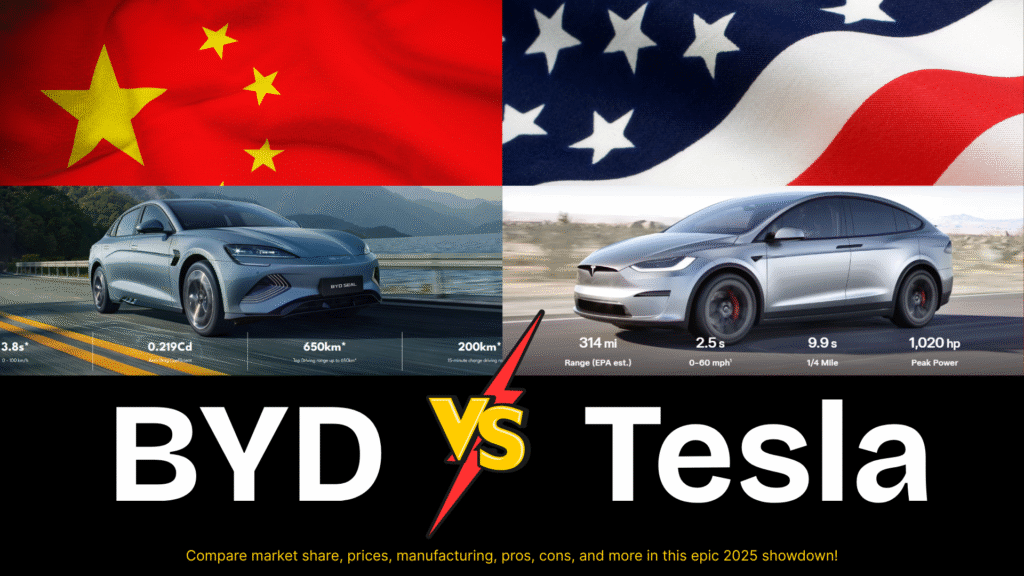

Imagine the Oscars, but for electric vehicles (EVs). Two global giants Tesla from the USA and BYD from China are fighting for the crown, dominating headlines and debates worldwide. With jaw-dropping technology, record-breaking sales, and endless social media buzz, this rivalry feels like a Hollywood blockbuster.

But the question is are we just falling for the hype? Or is this clash actually shaping the future of mobility? Let’s dive deep into the Tesla vs. BYD war of 2025 and find out who’s really winning in this EV showdown.

Who’s Leading the EV Race?

The race is tighter than ever.

In 2024:

- BYD pulled ahead in total vehicle sales: 4.27 million (including hybrids).

- Tesla sold 1.79 million pure electric vehicles.

But when we look only at pure EVs, Tesla had a slight edge:

- Tesla: 1.79 million

- BYD: 1.76 million

In Q1 2025, Tesla regained the lead with 386,810 EVs sold vs. BYD’s 300,114.

X (formerly Twitter) is buzzing with BYD fans calling it the “Tesla takedown,” but Tesla’s global brand is still holding strong.

Market Share: Who’s Winning Where?

- China (World’s largest EV market):

- BYD dominates with 29.7% NEV market share (April 2025).

- Tesla is far behind at just 3.2%, ranked #8.

- Europe:

- BYD outsold Tesla in April 2025: 7,231 vs. a 40% drop for Tesla due to Elon Musk’s controversial political affiliations.

- Global:

- Tesla still leads in pure EVs.

- BYD’s hybrid models boost its overall numbers.

- Tesla focuses on the U.S. and Europe, while BYD pushes into Latin America, Southeast Asia, and the Middle East.

Ownership: The Faces Behind the Machines

- Tesla:

- Founded: 2003

- CEO: Elon Musk

- Valuation: ~$800 billion (2024)

- Stock: NASDAQ: TSLA

- BYD:

- Founded: 1995

- CEO: Wang Chuanfu

- Valuation: ~$157 billion (2024)

- Stock: HKG: 1211

- Fun fact: Warren Buffett invested $232 million in 2008.

Musk’s persona brings both attention and backlash, while BYD keeps a lower, more focused profile.

Price Comparison: Luxury vs. Affordability

- BYD:

- Qin L Sedan: $16,600

- Seagull Hatchback: $9,500

- Seal (Model 3 rival) is significantly cheaper in global markets.

- Massive price cuts up to 34% in 2025.

- Tesla:

- Model 3 (China): $32,600

- Model Y: $38,000

- Offers occasional discounts (like $4,800 off Model 3/Y), but can’t match BYD’s low pricing.

BYD’s affordable pricing boosts adoption but eats into profits. Tesla maintains a premium vibe but risks missing the mass market.

Manufacturing: Where the Cars Are Made

- Tesla Factories:

- Fremont (USA), Shanghai (China), Berlin (Germany), Austin (Texas).

- High-tech centralized production.

- 947,000 vehicles from Shanghai alone in 2023.

- BYD Factories:

- Shenzhen HQ, plus Hungary, Turkey, Brazil, and Thailand.

- Plans for a third European plant in 2025.

- Exports 10% of vehicles.

- Controls battery supply and raw materials (like lithium).

Tesla is the Apple of EVs sleek, integrated, and elite. BYD is the Xiaomi affordable, efficient, and everywhere.

Pros and Cons: Tesla vs. BYD

Tesla Pros:

- Premium brand recognition

- Pure EV leader

- Advanced tech: FSD, Supercharger network (200 miles in 15 mins)

- High profit per car: $8,279

Tesla Cons:

- High prices limit access

- Sales drop in China & Europe

- Musk controversies hurt brand

- No low-cost EV yet (expected late 2025)

BYD Pros:

- Super affordable (Seagull = $9,500)

- Leads China’s NEV market

- Rapid growth in Europe, Latin America

- Own battery production lowers costs

- Tech like 5-minute charging & “God’s Eye” driver assist

BYD Cons:

- Hybrid sales inflate EV numbers

- 100% tariffs block U.S. entry

- Margins under pressure (47% profit drop in Q1 2024)

- Global brand still growing

Is the Tesla vs. BYD Hype Overblown?

Kind of. The hype is very real, but so are the achievements.

- Tesla: Still the luxury leader with unmatched tech and profit.

- BYD: The budget beast making EVs accessible to the world.

Tesla’s valuation is still 5x higher than BYD’s, but that gap is narrowing. The real story? This rivalry is pushing both to innovate faster and the whole world benefits.

What’s Next for 2025?

- Tesla: Working on a $25,000 EV to battle BYD’s pricing.

- BYD: Targeting 5.5 million vehicle sales in 2025, with 800,000+ exports.

Challenges ahead:

- Tesla: Musk controversies, no budget EV (yet).

- BYD: Global tariffs, brand recognition issues.

Both are disrupting the industry think of it as Scorsese vs. Bong Joon-ho: different styles, same goal—cinematic greatness.

Who Wins?

It depends on what you value:

- Want premium tech, luxury, and brand prestige? Tesla is your ride.

- Want affordability, fast charging, and a variety of models? BYD is your best bet.

Either way, this EV war isn’t just smoke it’s a signal that the future of driving is electric.

Read more articles : alpha-male-vs-sigma-male

FAQs About Tesla vs. BYD

- Is the Tesla vs. BYD battle just hype?

It’s real. BYD topped total vehicle sales (including hybrids), but Tesla leads pure EVs. - Who sells more EVs globally?

Tesla leads in pure EVs. BYD sells more when hybrids are included. - Why are BYD cars cheaper?

BYD makes its own batteries and components, slashing costs. - Where do they manufacture?

Tesla: USA, China, Germany. BYD: China, Hungary, Brazil, Turkey, and more. - What’s Tesla’s biggest advantage?

Advanced tech and a massive Supercharger network. - Can you buy BYD in the U.S.?

No 100% tariffs block BYD cars. Tesla rules the U.S. market. - Will BYD overtake Tesla in 2025?

Possibly. BYD aims to lead in pure EVs by market share, but Tesla’s upcoming models could shake things up.